Capital.com review and test

In our detailed test of the CFD broker capital.com, we were able to gather some interesting experiences with the broker. In our experience report we describe why capital.com is a good CFD broker and can keep up with other brokers.

Table of contents

What does the capital.com platform offer?

The trading platform of capital.com is overall very comprehensive and yet clearly structured. In the left sidebar you can find all the functions related to the account or trading. In our test, the informative trading view on the platform stood out positively. You can directly choose between your portfolio, the watchlist or the most actively traded asset. This facilitates both portfolio management and the search for new opportunities for CFD trading.

In the "Discover" section, you can find the most volatile and most traded CFDs as well as important information from the "News" section. We found it particularly positive in our capital.com test that a lot of emphasis is placed on providing important news here. Are news and the latest information very important for successful CFD trading.

Adjustable leverage for CFD trading

Capital.com is one of the few CFD brokers that offers the possibility to freely choose the level of leverage for CFD trading within the framework of the EU directives. This means that you do not have to trade with the standard leverage, but can also choose a lower leverage. You can choose the leverage in the account settings under trading options.

This option to adjust the leverage is a good feature and allows flexibility. In our tests, we experienced that this function is only offered by very few CFD brokers, or can only be made by contacting the support.

Learn CFD trading with capital.com

Good experience can be gained by beginners who want to get into CFD trading with capital.com. Capital.com offers a range of information materials such as video tutorial, FAQ and trading guides for different areas of CFD trading. The educational material for beginners in CFD trading is an important point in our test and should be positively highlighted.

Chart Analysis Tools:

Many tools for chart analysis are integrated in the capital.com platform and can be applied to the charts. These include, for example, the common drawing tools such as trend lines, chart formations or the Fibonacci retracement. But also indicators like the RSI, MACD, moving averages and much more are integrated. For beginners and everyday chart analysis, this should be sufficient. For those who do detailed chart analysis, the chart analysis platform of TradingView is more suitable. The highlight of our test is the possibility of linking TradingView with capital.com.

Connecting capital.com with TradingView

Capital.com is the only CFD broker in our tests that offers the possibility to link the trading account with TradingView. The big advantage of linking with TradingView is that you can place CFD orders directly from your chart analysis and do CFD trading directly without having to switch between two platforms.

Try it out and open your free account* at TradingView.

Which markets can be traded at capital.com?

In total, capital.com offers over 4000 markets tradable as CFDs. However, upon closer examination of the offer, one finds clear strengths at capital.com.

A plus point is the large offer of stock CFDs that have just been launched as an IPO. In our experience, capital.com is better and faster than many of the competing CFD brokers. As a user, you are also regularly informed about new IPOs, so you are always up-to-date.

capital.com also offers a wide range of CFDs on cryptocurrencies. Not only is the number large for the various cryptocurrencies, but also for the trading pairs. For example, Bitcoin CFDs can be traded not only against euros or dollars, but also against exotic currency pairs such as AUD, CHF, DKK, MXN and many more.

The selection of altcoins is also large with 19 different coins and capital.com is constantly striving to increase this offer.

Here is a list of cryptocurrencies that can be traded as CFDs:

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- Cardano

- Shiba Inu

- DogeCoin

- OMG Network

- TRON

- ATOM

- DigiByte

- VeChain

- Solana

- 0x

- LUNA

- IOTA

- Quantum

- MATIC

- Ravencoin

In our test, capital.com also scored well in commodities and offers a large selection of tradable commodity CFDs. A special feature is, among others, the trading of CFDs on CO2 certificates as well as the industrial metals nickel and aluminum. You can find out exactly what these are here in this table:

| Metals | Energy Raw Materials | Agricultural commodities | Other |

|---|---|---|---|

| Gold | Oil (WTI & Brent) | Cotton | CO2 certificates (no longer available) |

| Silver | Natural gas | Coffee | |

| Copper | Gas Oil | Wheat | |

| Platinum | Orange juice | ||

| Palladium | Sugar | ||

| Aluminum | Cocoa | ||

| Nickel |

Is capital.com reputable and regulated?

Like any CFD broker operating in the EU, capital.com must be subject to strict regulation. Capital.com holds licenses from the UK regulatory authorities Financial Conduct Authority ("FCA"), the Australian Securities and Investments Commission ("ASIC") and the Cyprus Securities and Exchange Commission ("CySEC"). The licenses of the regulatory authorities make capital.com a reputable and trustworthy CFD broker. Moreover, the CFD broker is also well-known and reputable in the financial industry and cooperates with brands such as Reuters, Deloitte or Investing.com.

To protect customer funds, capital.com participates in the "Investor Compensation Fund" over and above the statutory regulations.

What are the fees at capital.com?

In our test, we were able to make quite positive experiences with the fees of capital.com. Especially deposits and withdrawals are free of charge. The CFD broker also does not charge any fees for real-time price data and for educational materials.

Capital.com earns money mainly through the spreads charged. The spread is the difference between the buy and sell price and is shown and recognizable for each CFD. The amount of the spread varies from market to market. Overall, capital.com is in the midfield with its fees.

Another fee that is incurred when holding CFDs overnight is overnight funding. This is either deducted from the account or credited. Crediting overnight funding is rarely found, but with some short positions you can credit a small percentage daily. Compared to other CFD brokers, it is more common to find positive overnight funding credited to the account.

There is no inactivity fee at capital.com!

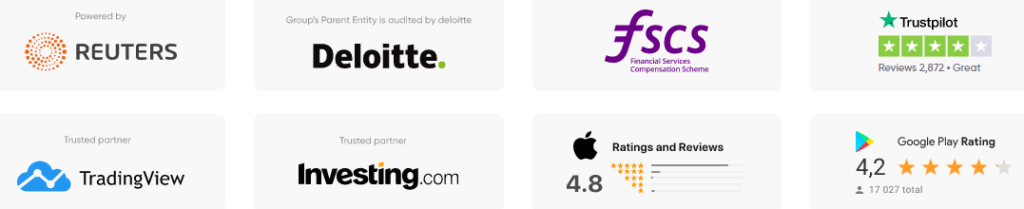

capital.com Test: Trading App

Part of our test is also the mobile trading app of capital.com. The app is very clear and very similar to the desktop version of the trading platform. CFD trading via the app can be done quickly and without much clicking around. What exactly should be displayed in the app in the bar, you can edit individually. This way, you can only display the markets that interest you. Overall, the smartphone app from capital.com makes a good impression in our test. It can be accessed quickly and reliably, as can the CFD platform itself.

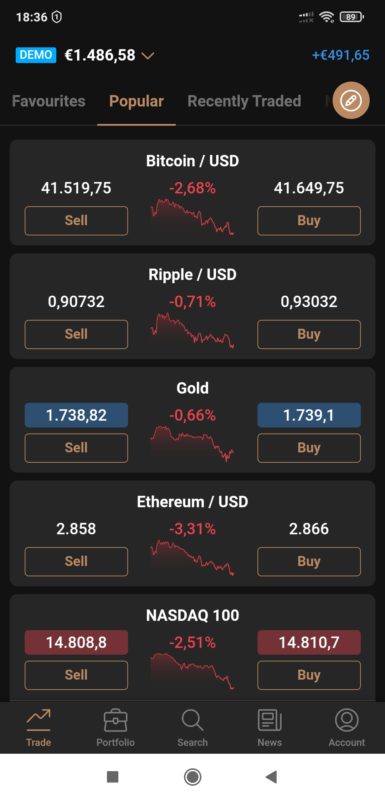

Does capital.com have a demo account?

Like other CFD brokers, capital.com offers every client a free demo account. Add this to any live account at the top right of the CFD platform. In the demo account you can test your trading skills or new trading strategies without risking your own capital. All functions are available in the demo account, which are also available in the live account.

How do deposits and withdrawals work at capital.com?

Deposits and withdrawals are completely free, no matter how many you make per month. The selection of deposit options is very large. The minimum deposit is 20€.

Among other things, you can use the following deposit methods:

- Credit card

- Paypal

- Apple Pay

- Trustly

- Sofotransfer

- Bank transfer

- Giropay

Withdrawals are processed by capital.com within a few business days and paid out without any problems. However, if there are any problems with deposits or withdrawals, the customer service is available quickly. In our test, we were able to make very positive experiences when tracing a withdrawal.

capital.com experience: Advantages and disadvantages at a glance:

In our test we could make some positive as well as negative experiences. For a better overview, we have summarized all the advantages and disadvantages of the CFD broker capital.com:

Advantages of capital.com:

- Wide range of CFDs on cryptocurrencies

- Link with TradingView possible

- MetaTrader 4 compatible

- Adjustable levers

- Training material for beginners

- Partial positive overnight funding

Disadvantages of capital.com:

- No alarm function

- No trailing stop loss

Evaluation and conclusion about capital.com:

In our experience, capital.com is a very good CFD broker and outperforms the top dogs in some aspects. Especially those who increasingly trade CFDs on cryptocurrencies and commodities are in good hands with capital.com. The fees are solid compared to other CFD brokers. A positive aspect here is that there is no inactivity fee.

A highlight at capital.com is the possibility to link the CFD account with TradingView. This allows you to do CFD trading directly from TradingView.

Both for beginners capital.com is a good address and one is supported here with the free learning material. But also for professional day traders capital.com is suitable, because the CFD platform is compatible with MetaTrader 4.